Little Known Facts About Simply Solar Illinois.

Little Known Facts About Simply Solar Illinois.

Blog Article

The Best Strategy To Use For Simply Solar Illinois

Table of Contents8 Simple Techniques For Simply Solar IllinoisThe Buzz on Simply Solar IllinoisThe Facts About Simply Solar Illinois RevealedExamine This Report about Simply Solar IllinoisThe Greatest Guide To Simply Solar Illinois

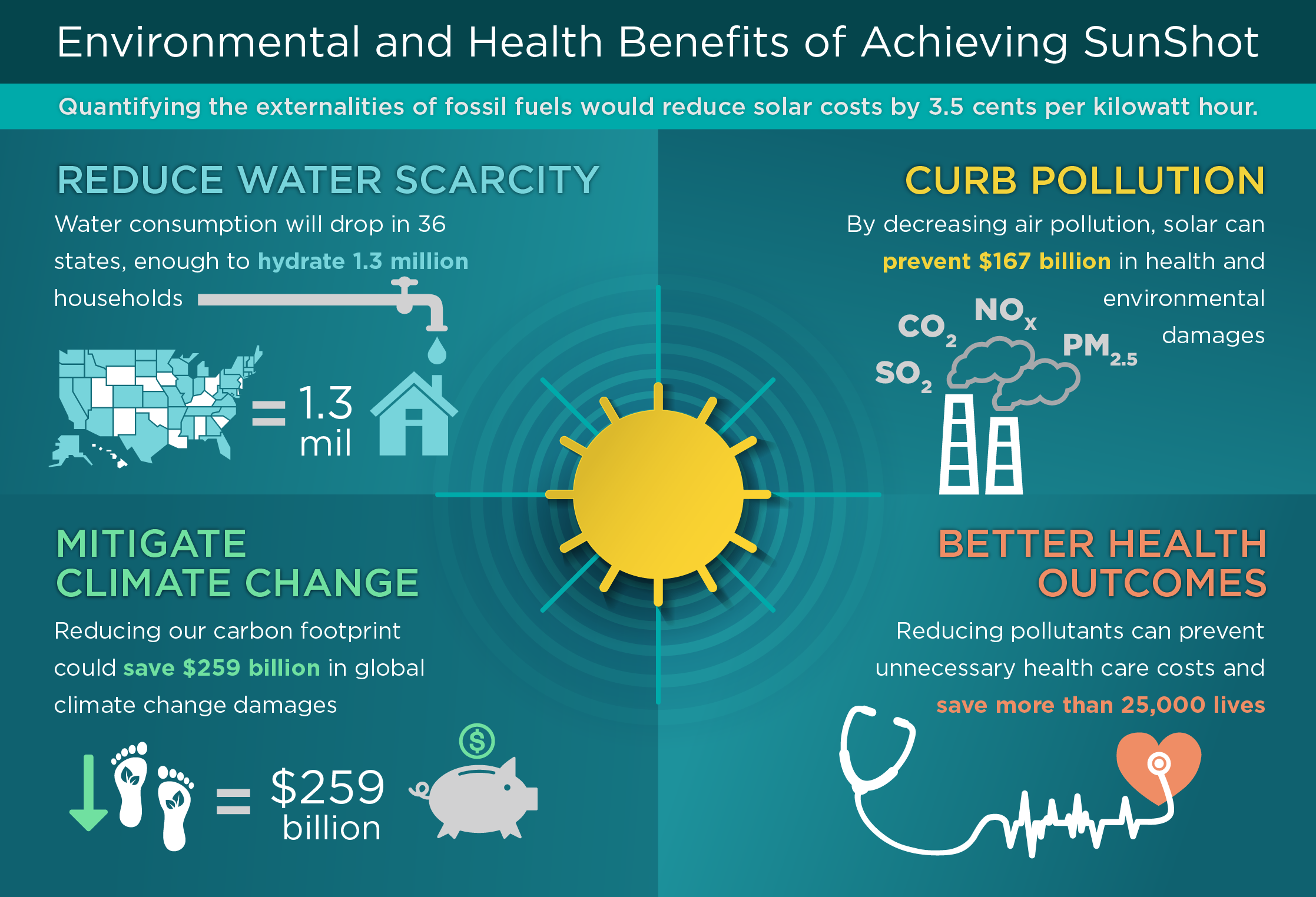

Our team partners with neighborhood areas throughout the Northeast and past to supply tidy, affordable and reputable power to cultivate healthy and balanced communities and maintain the lights on. A solar or storage task supplies a variety of advantages to the neighborhood it offers. As modern technology breakthroughs and the expense of solar and storage space decrease, the financial benefits of going solar remain to rise.Assistance for pollinator-friendly habitat Environment reconstruction on infected sites like brownfields and landfills Much required shade for livestock like lamb and chicken "Land banking" for future agricultural use and dirt high quality renovations Due to climate change, extreme weather is ending up being much more constant and turbulent. Consequently, property owners, organizations, neighborhoods, and energies are all becoming an increasing number of interested in safeguarding power supply options that supply resiliency and energy safety.

Ecological sustainability is one more vital chauffeur for companies buying solar power. Many companies have robust sustainability goals that consist of reducing greenhouse gas exhausts and making use of much less sources to help reduce their effect on the natural surroundings. There is an expanding necessity to address climate change and the pressure from consumers, is arriving degrees of companies.

The Ultimate Guide To Simply Solar Illinois

As we come close to 2025, the integration of solar panels in industrial jobs is no much longer just a choice yet a tactical requirement. This blogpost explores exactly how solar energy jobs and the complex advantages it brings to business structures. Solar panels have actually been utilized on residential structures for several years, however it's just just recently that they're becoming more usual in commercial construction.

It can power lighting, home heating, a/c and water heating in industrial buildings. The panels can be mounted on roofs, parking area and side lawns. In this article we go over how photovoltaic panels job and the benefits of making use of solar power in business buildings. Electricity prices in the united state are boosting, making it much more expensive for services to operate and extra challenging to plan ahead.

The United State Energy Details Administration expects electrical generation from solar to be the leading resource of growth in the united state power industry with completion of 2025, with 79 GW of new solar capacity forecasted ahead online over the following 2 years. In the EIA's Short-Term Energy Outlook, the firm claimed it anticipates eco-friendly power's total share of electricity generation to increase to 26% by the end of 2025

The smart Trick of Simply Solar Illinois That Nobody is Discussing

The photovoltaic or pv solar cell takes in solar radiation. The cables feed this DC electrical energy right into the solar inverter and convert it to alternating power (AC).

There are several ways to save solar energy: When solar power is fed right into an electrochemical battery, the chemical response on the battery components maintains the solar power. In a reverse reaction, the current departures from the battery storage space for intake. Thermal storage space utilizes mediums such as molten salt or water to retain and absorb the heat look at this now from the sun.

Solar panels significantly lower energy costs. While the preliminary investment can be high, overtime the expense of installing solar panels is recovered by the cash conserved on electrical energy expenses.

Simply Solar Illinois - Truths

By installing solar panels, a brand name shows that it respects the environment and is making an effort to lower its carbon impact. Structures that depend completely on electric grids are vulnerable to power blackouts that occur throughout bad weather condition or electrical system breakdowns. Solar panels set up with battery systems allow commercial buildings to continue to work during power interruptions.

Simply Solar Illinois for Beginners

Solar energy is among the cleanest kinds of power. With lasting service warranties and a production life of as much as 40-50 years, solar investments contribute considerably to environmental sustainability. This change in the direction of cleaner power sources can lead to more comprehensive financial benefits, consisting of minimized climate change and environmental deterioration expenses. In 2024, property owners can take advantage of federal solar tax motivations, permitting them to balance out nearly one-third of the acquisition cost of a planetary system via a 30% tax obligation credit.

Report this page